Notes to the

financial statements

For the financial year ended 31 December 2018

120

B A K E R T E C H N O L O G Y

L I M I T E D

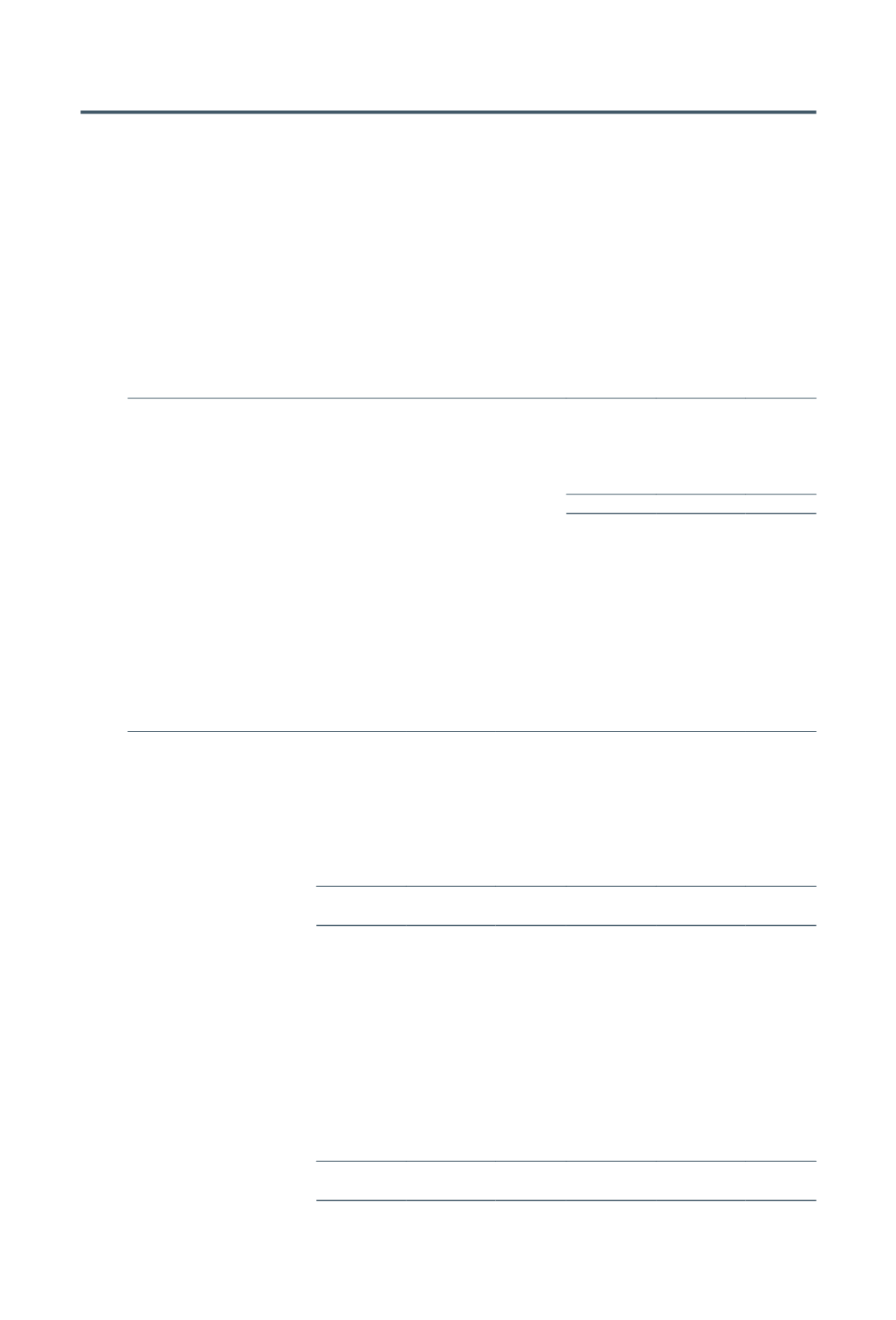

17.

Inventories and work-in-progress

Group

31.12.2018

31.12.2017 1.1.2017

$’000

$’000 $’000

Balance sheet:

Materials, components and spares (at cost)

765

634 473

Bunkering stocks (at cost)

411

–

–

Work-in-progress (at cost)

–

– 84,958

1,176

634 85,431

The cost of the goods sold reported in the statement of comprehensive income substantially

relates to materials, components and spares recognised as an expense for the year including

inventories written down amounting to $32,000 (2017: $501,000).

18.

Trade and other receivables

Group

Company

31.12.2018

31.12.2017 1.1.2017

31.12.2018

31.12.2017 1.1.2017

$’000

$’000 $’000

$’000

$’000 $’000

Trade receivables – net

21,323

1,702 4,132

–

832

Deposits

172

63

119

–

–

–

Downpayment for capital

expenditure

–

–

313

–

–

–

GST recoverable

500

153 382

10

–

77

Sundry receivables

1,295

761

651

–

–

94

Interest receivables

26

52

86

9

52

86

Total trade and other

receivables (current)

23,316

2,731 5,683

19

52 1,089

Trade and other

receivables (excluding

GST recoverable and

downpayment for capital

expenditure) (current)

22,816

2,578 4,988

9

52 1,012

Amount due from

subsidiaries (Note 19)

–

–

–

165,769

100,641 93,074

Loan to associate

(Note 14)

9,268

–

–

–

–

–

Cash and short-term

deposits (Note 20)

28,920

86,642 106,956

14,575

79,872 99,157

Total financial assets

carried at amortised cost

61,004

89,220 111,944

180,353

180,565 193,243

Trade receivables are non-interest bearing and are generally on 30 to 90 days’ terms. They are

recognised at their original invoiced amounts which represent their fair values on initial recognition.