for the year ended 31 December 2016

NOTES TO THE

FINANCIAL STATEMENTS

Annual Report 2016

-

122

-

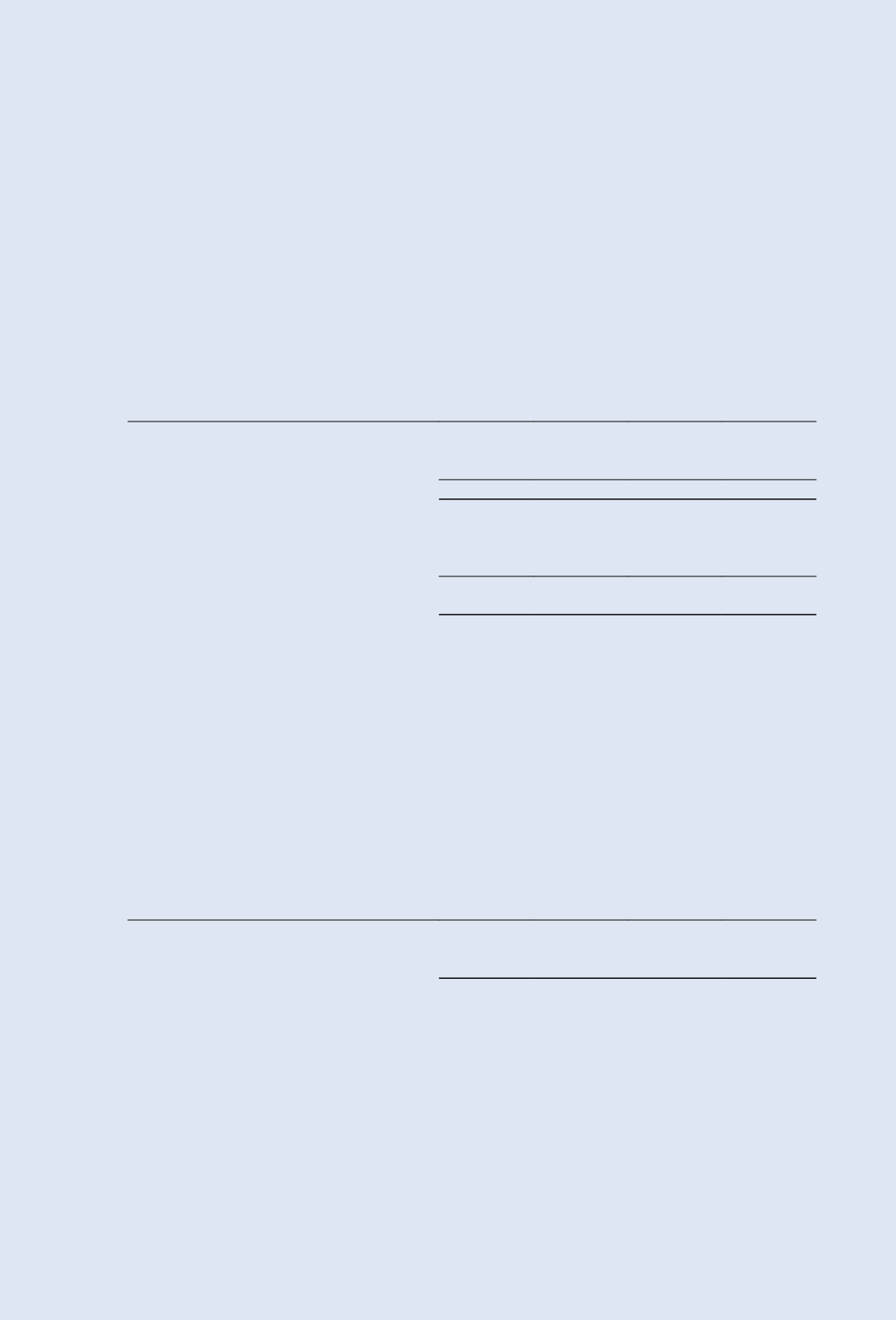

20.

Tradeandotherpayables

Group

Company

2016

2015

2016

2015

$’000

$’000

$’000

$’000

Trade payables

4,827

6,738

856

–

Other payables

3,217

6,874

385

604

Total trade and other payables

8,044

13,612

1,241

604

Trade and other payables

(excluding provision forwarranty)

6,370

11,206

1,241

604

Amount due to subsidiaries (Note 18)

–

–

5,653

38,696

Total financial liabilities carried

at amortised cost

6,370

11,206

6,894

39,300

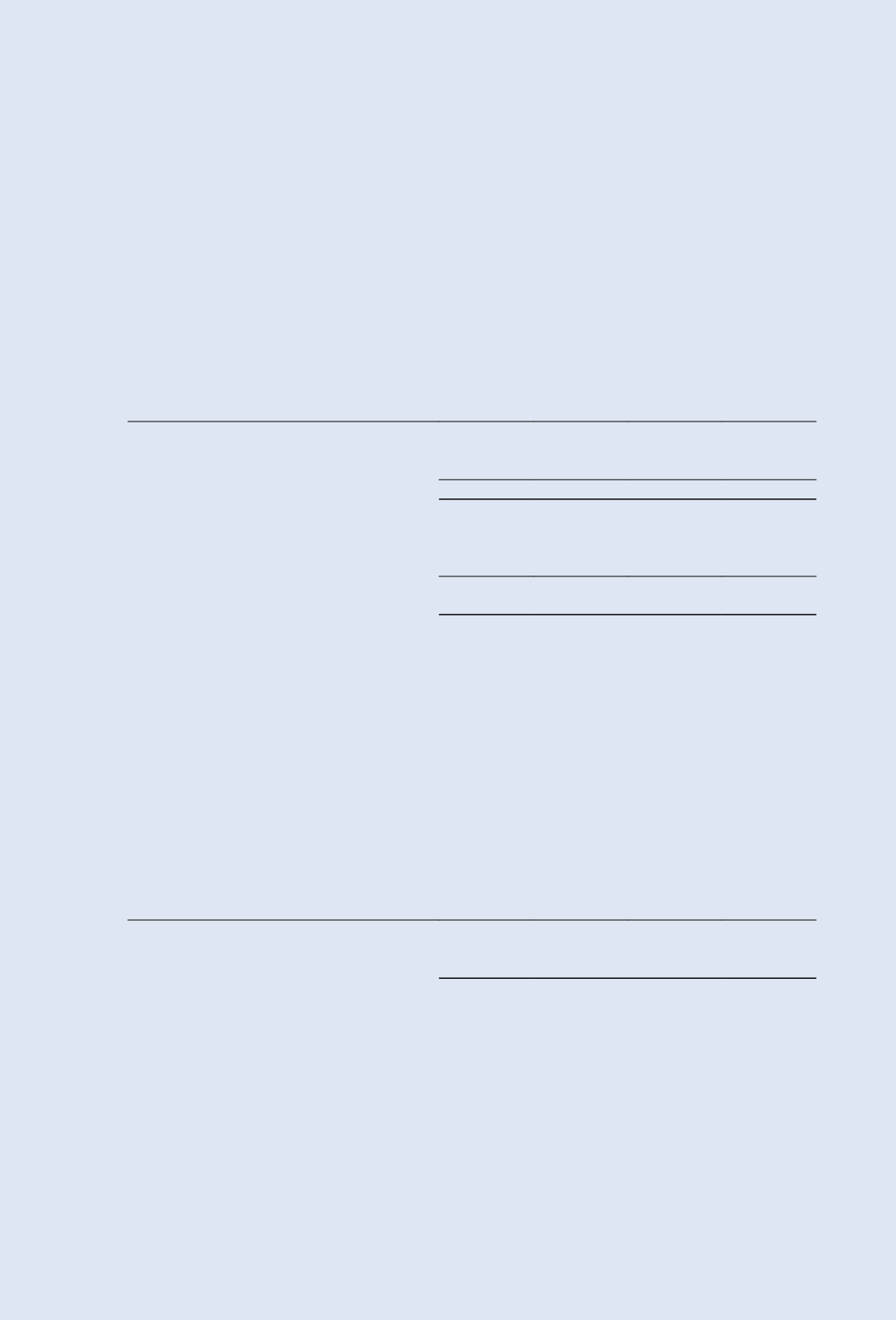

Trade payables are non-interest bearing and are normally settled on 30 to 90 days’ terms.

TheCompany’s trade payable as at 31December 2016 included an amount of $856,000 (2015: Nil) due to a

subsidiary.

The Group’s other payables includes a provision for warranty of approximately $1,674,000 (2015:

$2,406,000). During the financial year, the Group wrote back excess provision of approximately $645,000

(2015: $2,452,000). In line with the Group’s policy as discussed in Note 2.13, the write back of additional

provision in 2016 and in 2015 forwarrantywere resulted from the annual revision.

Trade payables denominated in foreign currencies at 31December are as follows:-

Group

Company

2016

2015

2016

2015

$’000

$’000

$’000

$’000

UnitedStatesDollar

1,320

1,109

856

–

Euro

344

33

–

–