for the year ended 31 December 2016

NOTES TO THE

FINANCIAL STATEMENTS

Baker Technology Limited

-

113

-

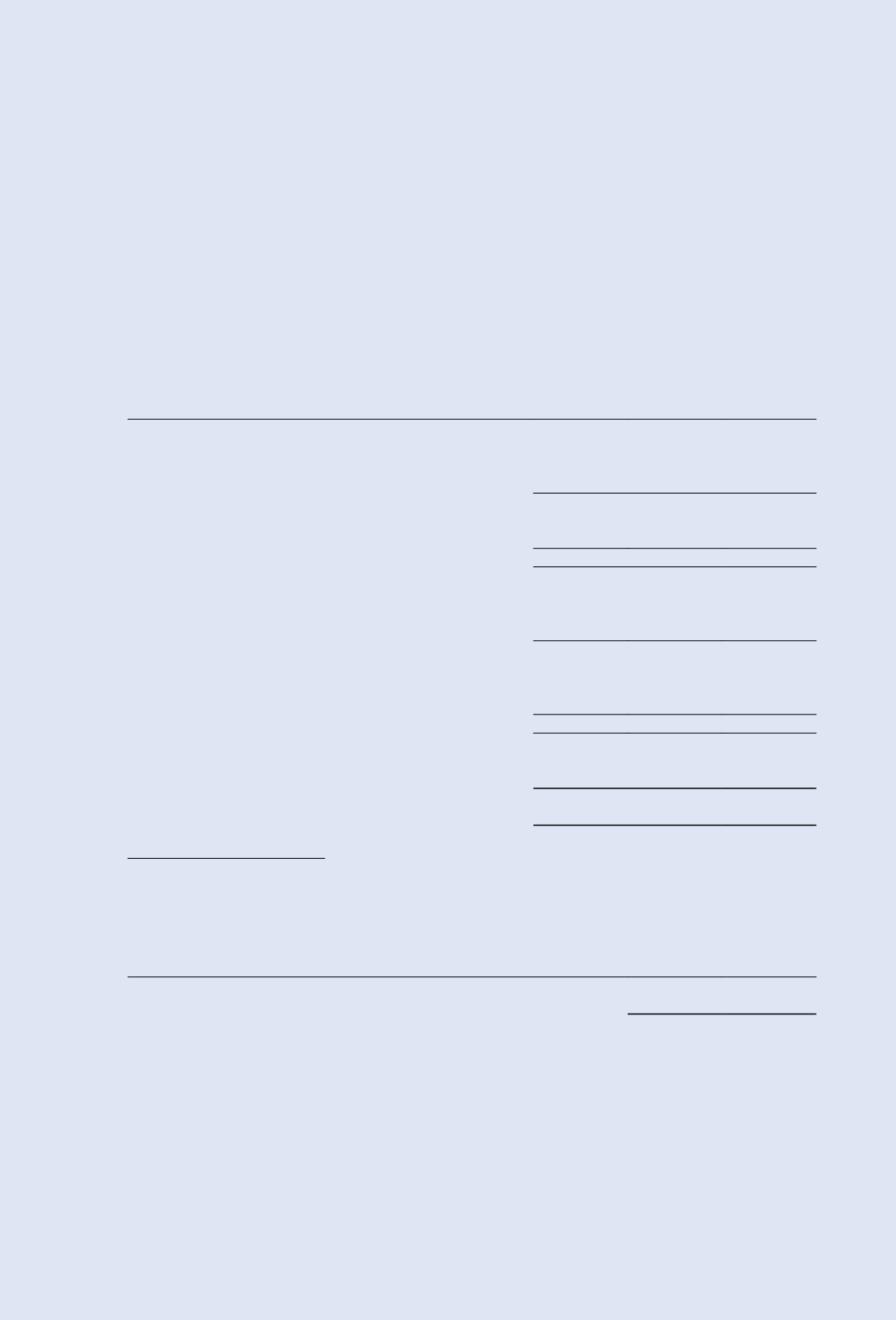

11.

Intangibleassets

Group

Goodwill

Vessel

design

Total

$’000

$’000

$’000

Cost:

At 1 January 2015

7,551

2,213

9,764

Addition during the year

–

227

227

At 31December 2015 and 1 January 2016

7,551

2,440

9,991

Addition during the year

–

105

105

At 31December 2016

7,551

2,545

10,096

Accumulated amortisation and impairment:

At 1 January 2015

–

–

–

Amortisation charge for the year

–

244

244

At 31December 2015 and 1 January 2016

–

244

244

Amortisation charge for the year

–

251

251

Impairment loss

7,551

–

7,551

At 31December 2016

7,551

495

8,046

Net carrying amount:

31December 2015

7,551

2,196

9,747

31December 2016

–

2,050

2,050

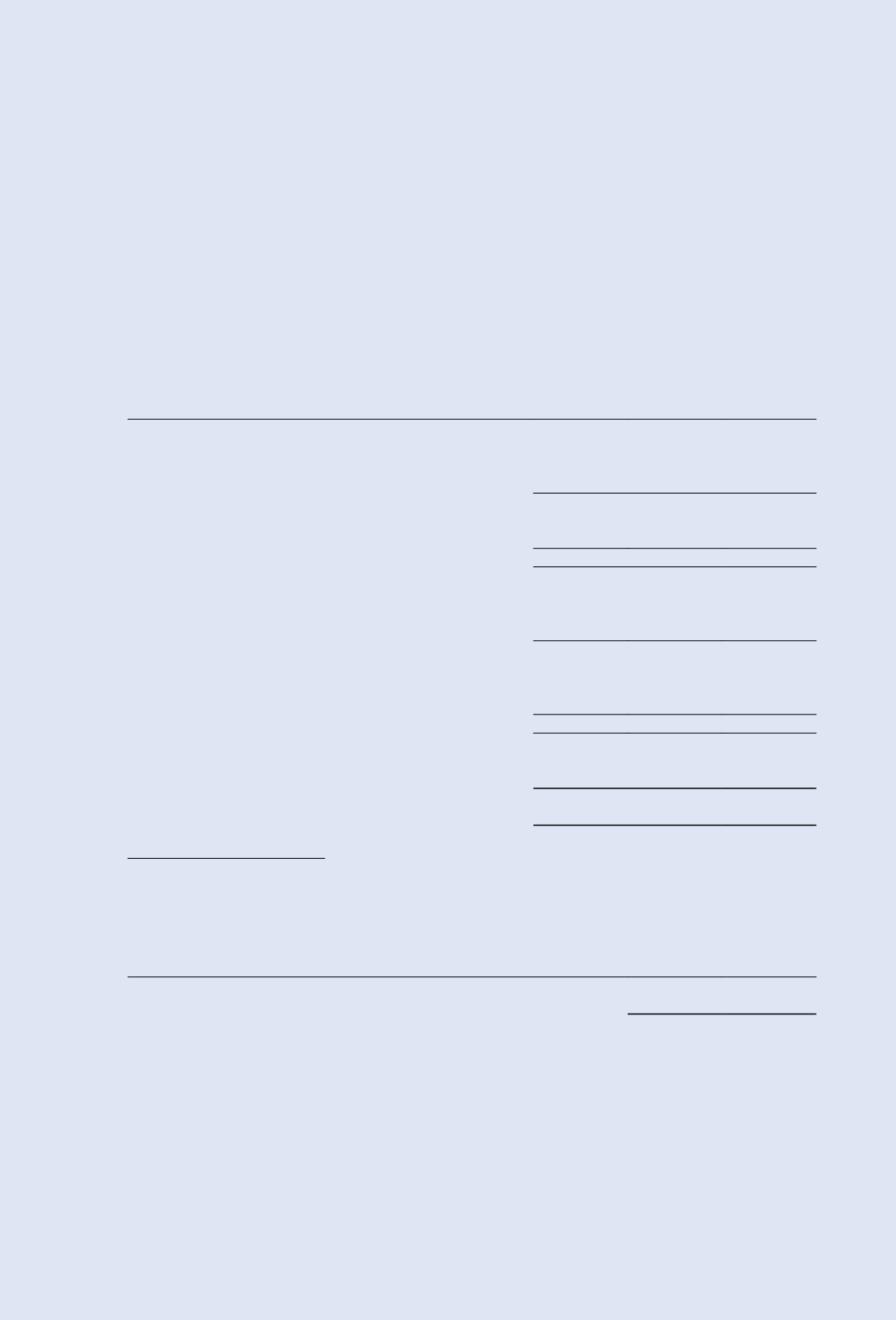

Impairment testing of goodwill

Thegoodwillwasderived from theacquisitionofSeaDeepShipyardPte.Ltd., thecashgeneratingunit (CGU).

Group

2016

2015

$’000

$’000

SeaDeepShipyardPte. Ltd.

–

7,551

The recoverable amount of theCGU has been determined based on value in use calculations using cash flow

projections from financial budgets approved bymanagement covering a five-year period.Management have

considered and determined the factors applied in these financial budgets.

Apre-taxdiscount rate of 11% (2015: 11%) per annum, which is commonly adoptedwithin the industry, was

applied to the cash flowprojections. Due to the extendedoil price downturn and the reduction inExploration

and Production spending of the oil and gas industry, management has forecasted a significant decline of

revenue in 2017, andmoderate recovery from 2018 to 2021 (2015: decline of revenue in 2016, and 4% per

annum from2017 to 2020).