Baker Technology LimitedAnnual Report 2014

133

27.

Financial riskmanagement objectives andpolicies (cont’d)

Foreign currency risk (cont’d)

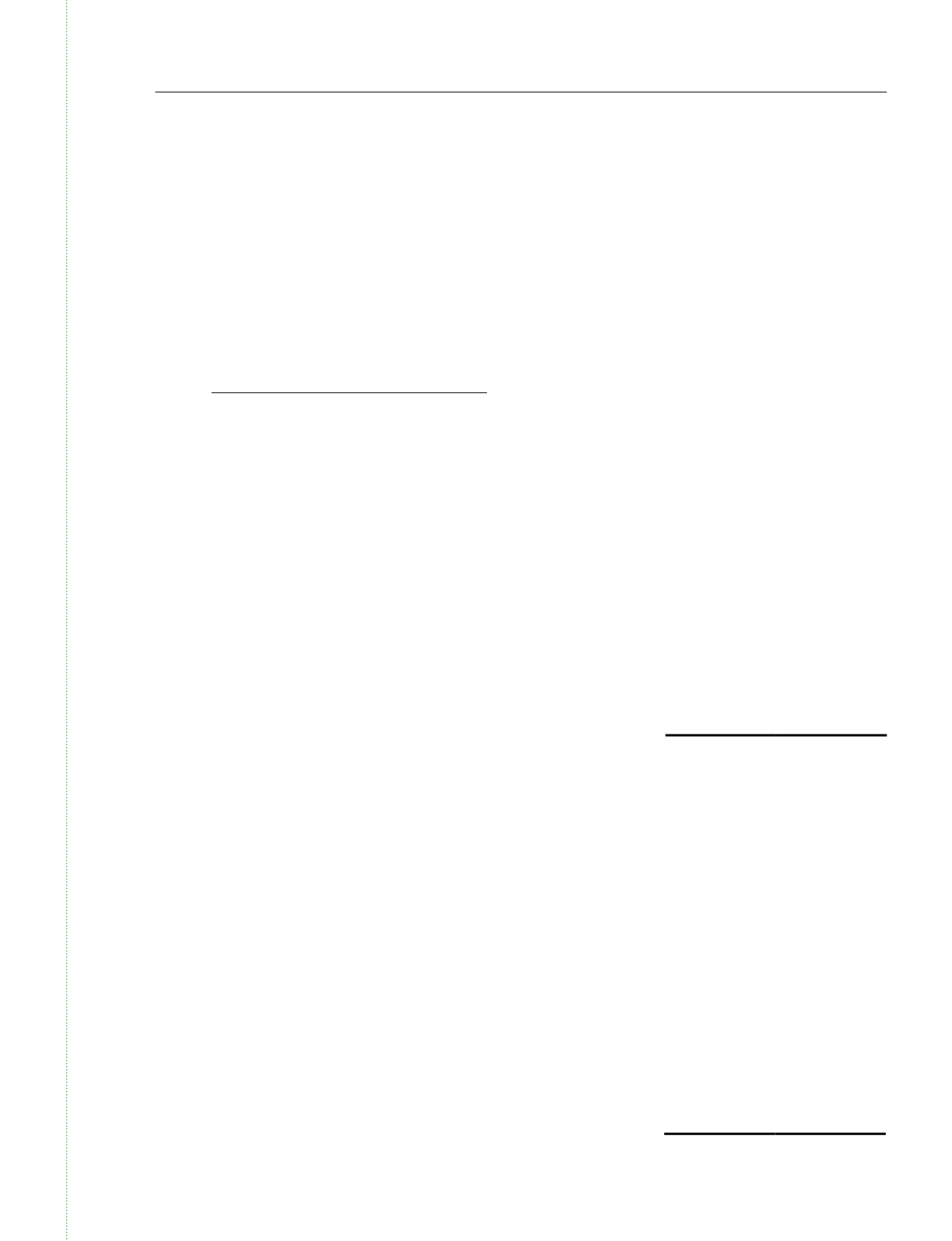

Sensitivity analysis for foreign currency risk

The following table demonstrates the sensitivity of theGroup’s profit net of tax to a reasonably possible

change in theUSD andEuroexchange rates against SGD, with all other variables held constant.

Group

2014

2013

$’000

$’000

Net profit

Net profit

USD / SGD – strengthened 3% (2013: 3%)

+1,766

+1,676

–weakened3% (2013: 3%)

–1,766

–1,676

Euro / SGD – strengthened 3% (2013: 3%)

+29

+289

–weakened 3% (2013: 3%)

–29

–289

28.

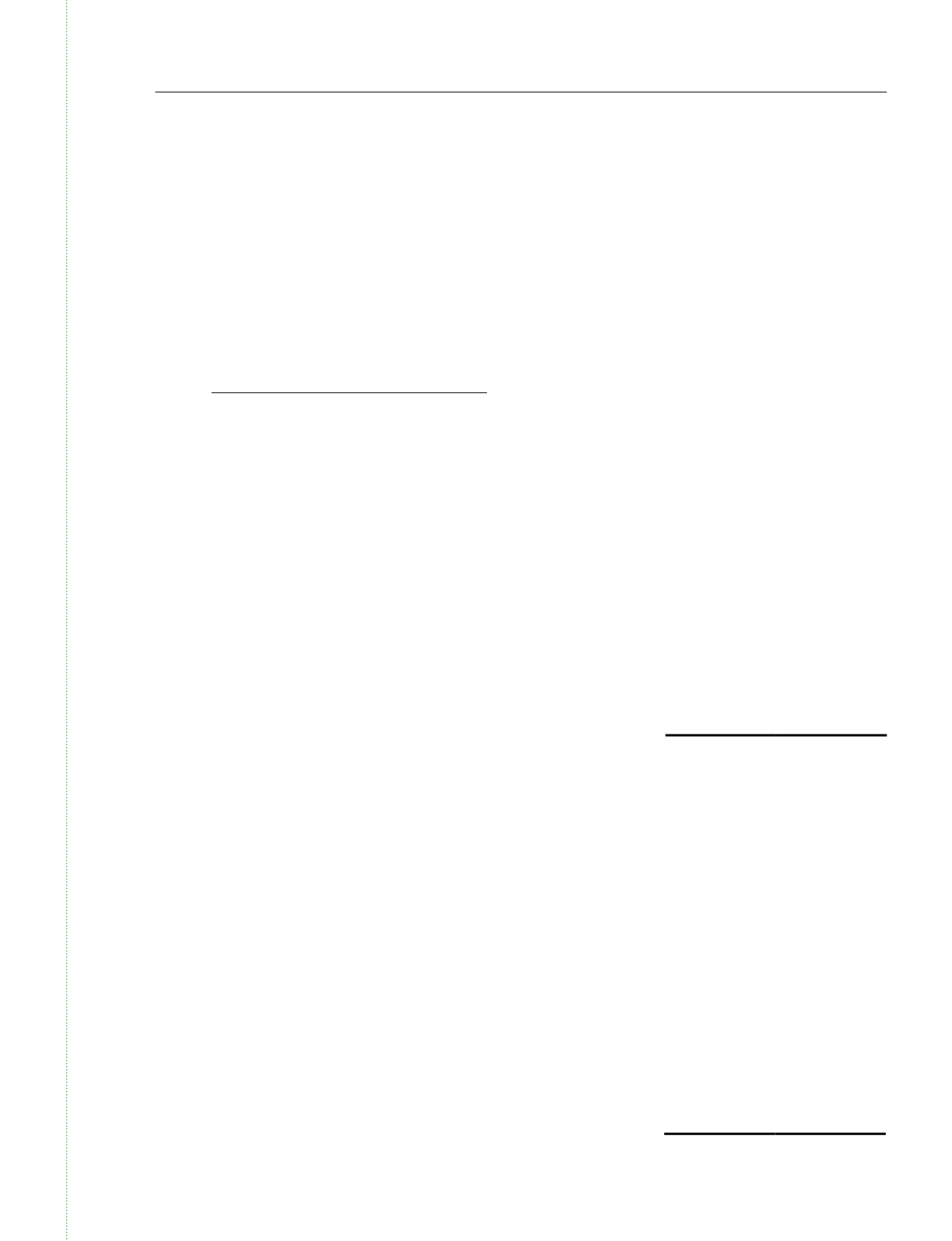

Fair valueof financial instruments

A.

Fair value of financial instruments by classes that are not carried at fair value and whose

carrying amounts are reasonable approximation of fair value

The carrying amounts of the trade receivables, deposits, amount due from / (to) subsidiaries, and

tradeandotherpayablesare reasonableapproximationof fair values,due to their short-termnature.

B.

Fair valueof financial instruments that are carried at fair value

Group andCompany

2014

2013

$

$

Non-current:

Available-for-sale financial assets

- Corporatebonds (quoted) - at fair value (Level 1)

7,698,494

2,117,444

NOTES TO THE

FINANCIAL STATEMENTS

For the financial year ended 31December 2014