Corporate

Governance

Corporate

Governance

55

BAKER TECHNOLOGY LIMITEDANNUAL REPORT 2012

54

BAKER TECHNOLOGY LIMITEDANNUAL REPORT 2012

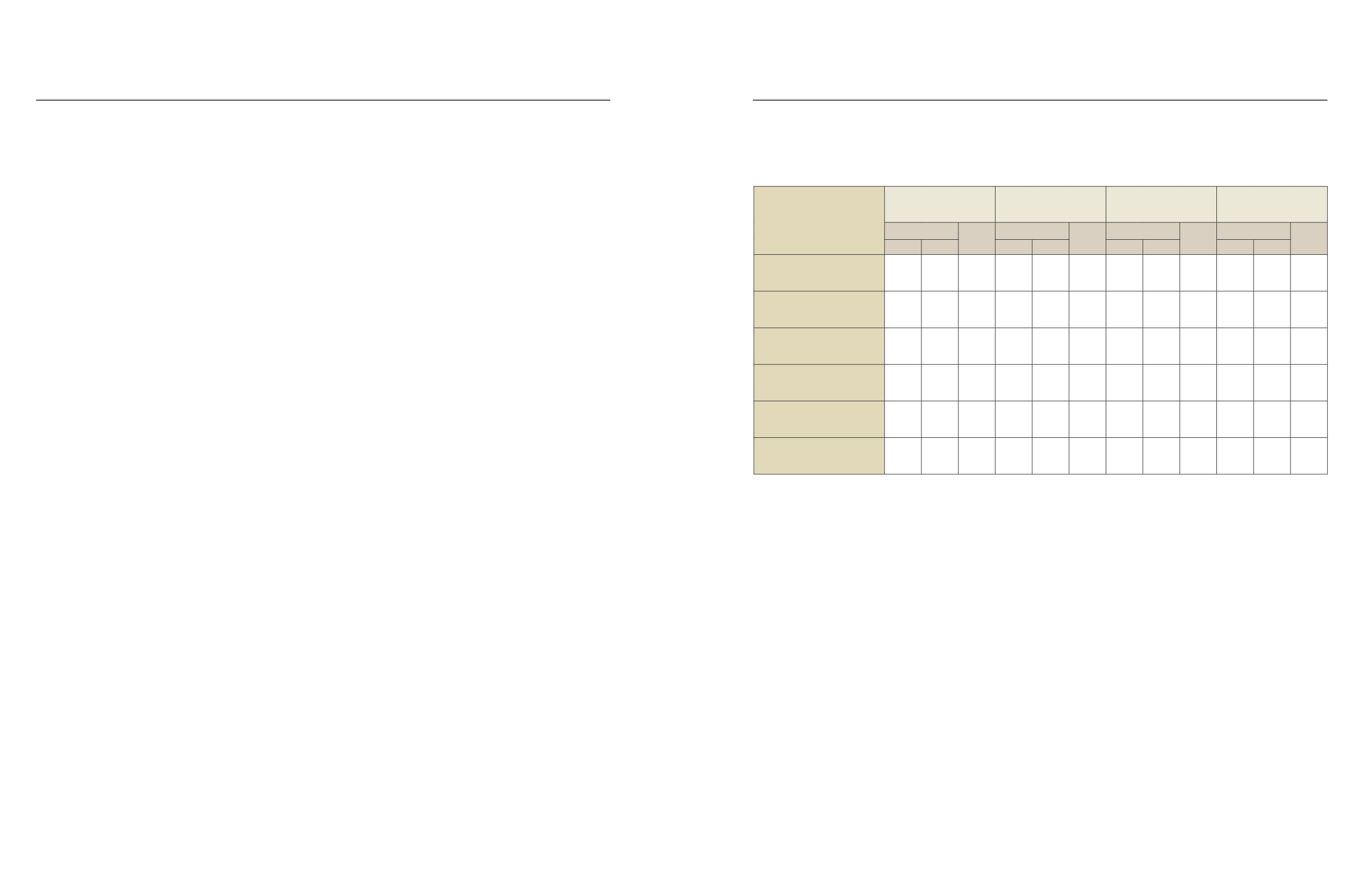

Directors’Attendance forYear2012

Name of Directors

Board

Audit Committee Nominating

Committee

Remuneration

Committee

No. of Meetings

%

Attended

No. of Meetings

%

Attended

No. of Meetings

%

Attended

No. of Meetings

%

Attended

Held Attended

Held Attended

Held Attended

Held Attended

LimHo Seng

6

6

100

5

5

100

1

1

100

1

1

100

Dr Benety Chang

6

6

100

5

5*

100

1

1

100

1

1*

100

Anthony Sabastian Aurol

6

6

100

5

4*

80

1

1*

100

1

1*

100

Tan YangGuan

6

6

100

5

5

100

1

1*

100

1

1

100

Wong Kwan Seng Robert

6

6

100

5

5*

100

1

1*

100

1

1*

100

WongMeng Yeng

6

6

100

5

5

100

1

1

100

1

1

100

Note

* By invitation

Baker Tech received its second consecutive Silver award

for Best Annual Report for companies under S$300

million in market capitalisation at the 2012 Singapore

Corporate awards for excellence in the presentation of

its financial reporting, high level of corporate disclosures

and transparency. In theprevious threeconsecutiveyears,

the Group won awards in the “Best Managed Board”

category. The Singapore Corporate Awards organised

by The Business Times and supported by The Singapore

Exchange is to showcase and honour excellence in

shareholder communications and corporate governance

amongst SGX-listed companies.

Since the inceptionof theGovernanceand Transparency

Index (“GTI”), co-published by The Business Times and

theNUSCorporateGovernanceand Financial Reporting

Centre, Baker Tech has placed much emphasis on using

it as a yard stick and striving to improve ourselves with

each issueof theGTI ranking. Throughcontinuous efforts,

our GTI scores have improved by 12 points, from 54

in 2011 to 66 in 2012 and were ranked 30

th

amongst

more than 600 companies.

This report describes the Company’s corporate

governancepracticeswith specific reference to theCode

of CorporateGovernance 2005 (the “Code”), except as

otherwise explained in the report.

BOARDMATTERS

TheBoard’sConductof itsAffairs

Principle1:

Every company should be headed by an effective

Board to lead and control the company. The Board is

collectively responsible for the success of the company.

The Board works with Management to achieve this and

theManagement remains accountable to the Board.

The Board supervises the overall management of the

business and affairs of the Group. The Board also sets

the Company’s values and standards, and ensures its

obligations to all stakeholders are met and understood.

While the Board remains responsible for providing

oversight in the preparation and presentation of the

financial statements, it has delegated to Management

the task of ensuring that the financial statements are

drawn up and presented in compliancewith the relevant

provisionsof theSingaporeCompaniesAct,Cap.50and

the Singapore Financial Reporting Standards. The Board

has also delegated responsibility to the Chief Executive

Officer to manage the business of the Company, and to

its various Board Committees to deal with the specific

areas described hereinafter.

Besides the above, the Board also approves theGroup’s

appointment of Boardmembers and senior management

staff, key business initiatives, major investments and

funding decisions, and interested person transactions.

These functions are carried out by the Boarddirectly and

through its committees.

All Directors (excluding those who have abstained

from voting on matters in which they were interested)

objectively tookdecisions in the interestsof theCompany.

The Board conducts regular scheduled meetings on a

quarterly basis. Ad-hoc meetings are convened as and

when circumstances require. The Company’s Articles of

Association allow meetings to be conducted by way of

telephonic and video-conferencing. In 2012, the Board

met six times. To facilitatemaximumattendance, meeting

dates of Board and Board Committees are scheduled

with ample notice.

Board committees comprising the Audit Committee,

the Remuneration Committee and the Nominating

Committee were established to assist the Board in the

dischargeof its duties. TheseCommittees reviewormake

recommendations to the Board on matters within their

specific terms of reference.

The attendance of Directors at Board and committee

meetings in the financial year 2012 is as follows:

During the year, Directors are provided with regular

updates and informed of changes in the relevant laws

and regulations to enable them to keep pace with

regulatory changes or which have a material bearing

on the Group. In addition, when there are events on

seminars or training in areas such as accounting and

legal etc including updates which are relevant to the

Group, the Directors are encouraged to attend at the

Company’s expense.

New Directors are provided with information on the

corporate background, key personnel, core businesses,

group structure and financial statements of the

Group. Directors are also kept abreast on regulatory

requirements concerning disclosure of interests and

restrictions on dealings in securities. The Company

also provides a write-up on the directors’ duties and

responsibilities to assist him in the exercise of his legal,

fiduciary and statutory duties under the Singapore

Companies Act, the Listing Manual of the Singapore

Exchange Securities Trading Limited (“SGX-ST”), the

Code, Singapore securities legislation and the internal

guidelines on securities trading. No new Director was

appointed in FY2012.

BoardCompositionandBalance

Principle2:

There should be a strong and independent element on

the Board, which is able to exercise objective judgement

on corporate affairs independently, in particular,

from Management. No individual or small group of

individuals should be allowed to dominate the Board’s

decisionmaking.